Climeworks' cost-down, scale-up strategy — with full ramp-up of Mammoth plant a few years away

Zurich-based Climeworks reached a major milestone in 2024 when it began operating its second direct air capture and carbon mineralization (DACCM) plant in Iceland, known as Mammoth. Designed to eventually capture 36,000 metric tons of CO2 per year when fully ramped up, Mammoth is among the world’s largest direct air capture facilities.

Since startup, however, the plant has issued only 383 tons of certified carbon credits (one credit equals one ton of CO2 removed) reflecting the high operating costs per ton that continue to challenge large-scale DAC deployment. Mammoth’s nearby predecessor, the Orca pilot plant, has a capacity of 4,000 tons per year but, as of January 19, 2026, has issued fewer than 2,000 certified credits.

According to cdr.fyi, Climeworks has pre-sold nearly 400,000 carbon credits to be generated at Mammoth and Orca. Buyers include large corporations such as Schneider Electric, SAP, and NGK, as well as individual purchasers.

Capturing CO2 at Mammoth

Mammoth captures CO2 from ambient air drawn into the DAC plant by industrial fans. The CO2 binds chemically to beads of solid sorbent held in a mesh structure, forming a filter. When the sorbent becomes saturated with CO2, it is heated under vaccum to about 100oC, releasing a concentrated stream of CO2, and enabling the beads to be reused.

Heat and electricity are supplied by the nearby Hellisheiði geothermal power plant. Based on a life-cycle assessment cited in Mammoth's Public Project Description filed with the Puro Registry of puro.earth, the plant is expected to become carbon-negative once fully operational.

The company's most recent output audit report for Mammoth — filed with the Puro.earth carbon credit registrar on December 3, 2025 — identifies May 2029 as the expected timeframe in which Mammoth will achieve full-scale ramp-up.

CO2 underground storage

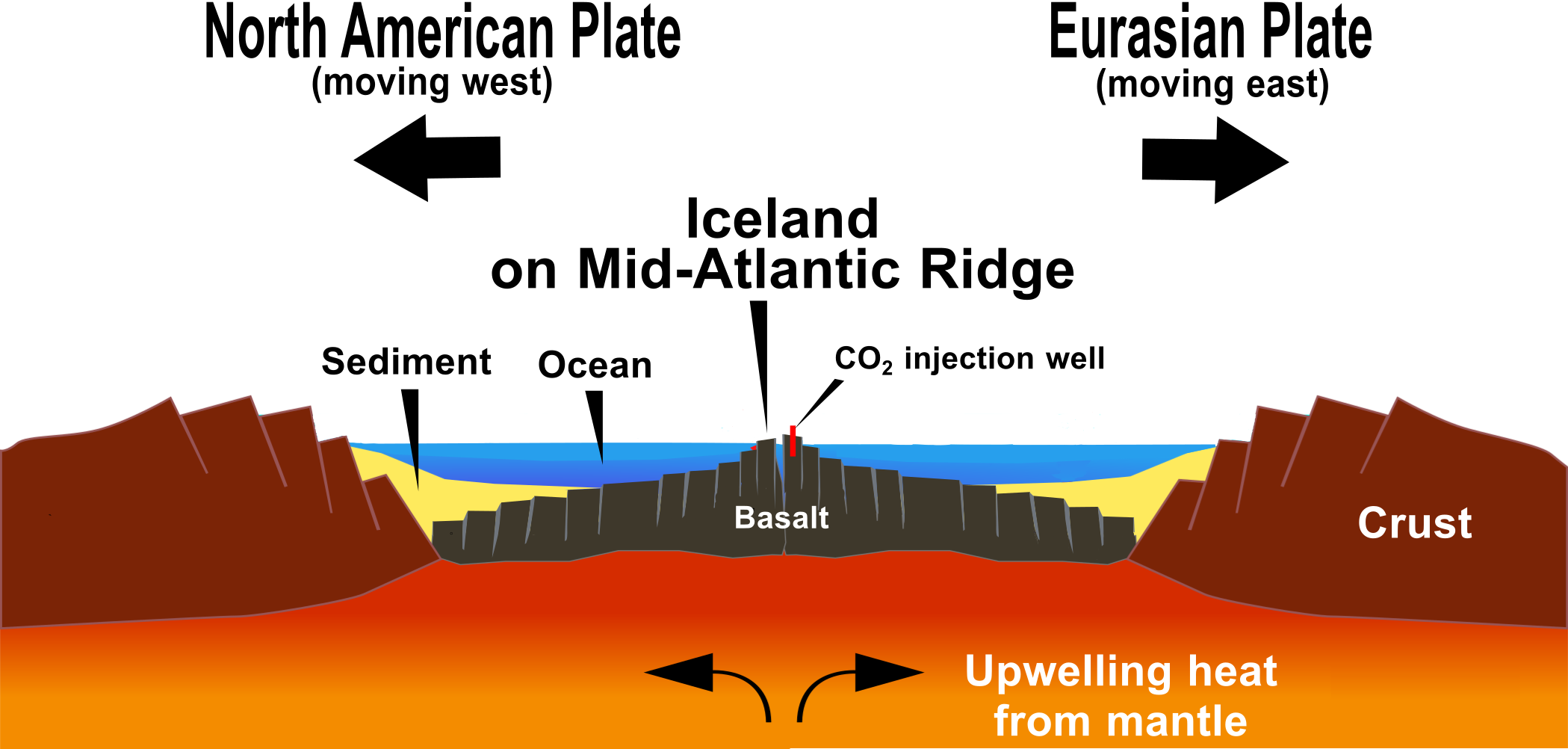

Mammoth and Orca store captured CO2 underground through carbon mineralization, in which the gas reacts with basalt to form stable carbonate minerals. Injection occurs at depths of at least 350 meters, where pressure keeps the CO2 dissolved in water. The CO2 is compressed to about 20 bar (290 psi), mixed with water, and piped to injection wells.

Basalt in Iceland solidified from lava that emerged along the Mid-Atlantic Rift Zone, creating the island atop the Mid-Atlantic Ridge (see cross-section below). Outside Iceland, the only other region where DAC with carbon mineralization (DACCM) is currently deployed at scale is the East African Rift Zone (see geoCDR News article on Kenya becoming a DACCM demonstration hub).

Underground injection wells and monitoring wells are operated by Carbfix, a subsidiary of Reykjavik Energy, which owns the Hellisheiði geothermal power plant. The geothermal plant itself annually produces more than 40,000 tons of CO2 and 10,000 tonnes of hydrogen sulfide (H2S) gas which are natural components of the hot ground water pumped from the power plant's deep geothermal wells. The CO2 and H2S from the power plant are captured from the plant's exhaust and are pipelined for underground storage into the same basalt layers used by Mammoth and Orca.

Cost reduction effort and carbon credits

Climeworks is installing its new Generation 3 sorbent and collector containers at Mammoth to improve CO2 capture efficiency. Generation 3 technology uses novel structured sorbent materials, replacing earlier packed filter beds used in previous technology generations. The new structures increase surface contact with CO2, cutting capture and release times by at least half. The new filters capture more than twice as much CO2, use roughly half the energy, and are designed to last three times longer than previous materials.

The company is working to reduce Mammoth’s cost per ton of CO2 captured so its credits can compete with nature-based carbon removal methods such as bioenergy with carbon capture and storage (BECCS), enhanced rock weathering (ERW), biochar, and afforestation and reforestation (ARR). While these methods typically offer lower storage durability — roughly 40 to 300 years compared with more than 1,000 years for DAC with mineral storage — the permanence premium has allowed DAC credits to command higher prices.

While Mammoth ramps up, Climeworks offers buyers a phased, seven-year delivery portfolio. Early credits are generated by lower-durability, nature-based methods through partners such as Stockholm Exergi, Alt Carbon, and Tellus, with later deliveries shifting to higher-durability DAC-based credits. The approach allows Climeworks to build market presence while its flagship plant matures.

As of January 16, 2026, Climeworks' website listed nature-based credits generated by nature-based methods at $100 per ton and DAC-generated credits at $500 per ton. The company said in 2024 that it aims to reduce its cost of DAC carbon removal to $75-$150 per ton by 2050.

In May 2025, media coverage Mammoth's issuance of just 1,400 carbon credits to date, versus its 36,000-ton capacity. In a May 2025 EnergyNow.com podcast, co-founder and co-CEO, Jan Wurzbacher, emphasized the slow, iterative nature of scaling new technology and described multiple design iterations of the DAC equipment.

Other recent developments

$162 million in new equity funding

Climeworks announced new funding of $162 million (USD), taking the company's total funding since its inception in 2009 to over $1 billion. The capital will be directed to developing lower cost DAC technology and expanding the use of phased carbon removal portfolios. Investors included Bigpoint Holding, Partners Group, and other existing investors.

In the July 2, 2025 funding announcement, Christoph Gebald, co-CEO and co-founder of Climeworks, said "Direct Air Capture has gone from experiment to essential — and we’re focused on scaling it by driving down costs and pushing innovation. Our hybrid model (of portfolios) builds long-term demand while generating cash flow today, helping us grow a market that investors now see as inevitable. Crossing the $1 billion equity mark isn’t just a milestone — it shows that carbon removal is real, needed, and here to stay.”

Launch of mobile demonstration DAC unit in Saudi Arabia

In July 2025, Climeworks launched a mobile DAC testing unit before an audience of dignitaries in Riyadh, Saudi Arabia. The demonstration was sponsored by the Saudi Ministry of Energy and , along with Climeworks. The DAC unit is testing performance in hot arid conditions, different from Iceland. As part of its goal of achieving net-zero by 2060, Saudi Arabia has an ambition to capture and utilize up to 44 million tons of CO2 annually by 2035 through the development of large-scale hubs.

Uncertainty in Project Cypress DAC hub in Louisiana (USA)

Federal budget wrangling in the U.S. has clouded the future of Project Cypress, a planned DAC hub in the southeastern U.S. state of Lousiana. Climeworks is a partner in the project, sharing in the initial award of $50 million of federal funding that was announced by the U.S. Department of Energy (DOE) in 2024 during the Biden administration. This first tranche of a potential $600 million award was for planning, design, and engagement with the local community and labor.

Climeworks announced in May 2025 (during the Trump administration) that it was cutting its nearly 500-person workforce by about 20%, citing lack of clarity about federal funding of their "next plant in the U.S." (presumably Project Cypress) as one of the reasons. An article published on Trellis on October 7, 2025 reported that a source at the DOE indicated funding had not been cut for Project Cypress, even though a DOE list was circulating on the internet showing the project as terminated. The article said Climeworks and a partner, Heirloom, indicated they had not been notified of a cancellation. A project map on Climeworks' website in January 2026 showed the project status as in the planning stage.

DAC Innovation Center launched

Climeworks announced on December 4, 2025 the launch of its DAC Innovation Center in Zurich, Switzerland . The facility focuses on small to mid-scale DAC plants, bringing together more than 50 engineers and scientists. The facility integrates materials science, prototyping, system optimization and reliability testing to accelerate breakthroughs in sorbents, energy efficiency and scalable plant design. The announcement said the facility is designed as the engine room for Climeworks' DAC cost-down and scale-up strategy. Co-Chief Executive Jan Wurzbacher said, "The world needs carbon removals at massive scale — and that means cost reduction is mission-critical. The Climeworks DAC Innovation Center is how we turn our recent breakthroughs into deployable, efficient, more affordable solutions."

Looking ahead

The DAC industry as a whole has been said to be within the so-called "valley of death" — that difficult period between a business's startup and its profitable commercial operation. "To escape the valley of death, DAC developers need project financing — the kind of structured capital that backs wind farms or liquified natural gas terminals," wrote Phil De Luna, a Canadian materials scientist and Chief Carbon Scientist and Head of Engineering at the carbon removal developer Deep Sky.

As one of the largest players in DAC, Climeworks is a bellweather of the industry. Although the company has made significant technical progress, it still faces major cost, financing, and policy challenges, particularly amid uncertainty over U.S. federal support. Many DAC startups face these same challenges, without being as well stablished as Climeworks.

But one industry observer discounts Climeworks' challenging situation as a red flag for the DAC industry. "I don’t believe that Climeworks’ apparent challenges should be read as a harbinger of DAC’s impending demise." said Andrew Shebbeare in a May 2025 blog post of London-based venture capital firm Counteract, where he is a partner.

Shebbeare foresees a consolidation of DAC companies in the next few years as funding tightens and the more established DAC operators need new technology. "I expect Climeworks will become acquisitive, that Oxy (the U.S.-based oil company) will continue to look for complementary DAC companies to join their emerging , and that other energy players will follow their example," he wrote.

Climeworks aims to remove 1 million by 2030 with DAC, so it will be interesting to watch the company evolve as it navigates the technical and financial headwinds of scaling up DAC.